Comparison with Other Market Indices

Live Stock Market Index Performance – The Live Stock Market Index exhibits distinct performance characteristics compared to other major market indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. While the indices share some similarities, they also differ in volatility, risk-return profiles, and factors influencing their performance.

The S&P 500, a broad-based index representing the 500 largest publicly traded companies in the US, often serves as a benchmark for the overall US stock market. The Dow Jones Industrial Average, a narrower index comprising 30 blue-chip companies, is known for its long history and stability.

The Nasdaq Composite, dominated by technology and growth stocks, is recognized for its volatility and high-growth potential.

Similarities

- All three indices exhibit positive long-term growth trends, reflecting the overall growth of the US economy and corporate earnings.

- They are influenced by macroeconomic factors such as interest rates, inflation, and economic growth.

- They are subject to market fluctuations and can experience periods of volatility and corrections.

Differences

- Volatility:The Nasdaq Composite tends to be more volatile than the S&P 500 and Dow Jones Industrial Average due to its concentration in technology stocks, which are often subject to rapid growth and decline.

- Risk-return profile:The Live Stock Market Index generally has a higher risk-return profile than the S&P 500 and Dow Jones Industrial Average, as livestock-related industries are often affected by factors such as weather conditions, disease outbreaks, and government regulations.

- Sector composition:The Live Stock Market Index focuses exclusively on the livestock industry, while the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite represent a diverse range of industries.

Factors Influencing Performance

- Livestock demand and supply:Changes in consumer demand for meat and other livestock products, as well as supply-side factors like disease outbreaks or weather conditions, can significantly impact the Live Stock Market Index.

- Global economic conditions:Economic growth and recessionary periods can affect the demand for livestock products, influencing the performance of the index.

- Government policies:Regulations related to livestock production, trade, and food safety can impact the profitability and outlook of companies in the industry.

Sector and Industry Analysis

The Live Stock Market Index comprises a diverse range of sectors and industries, each contributing to the index’s overall performance. A comprehensive analysis of these sectors and industries reveals the key drivers of the index’s performance and provides insights into the dynamics of the livestock market.

The livestock sector is influenced by various factors, including demand-supply dynamics, technological advancements, and regulatory changes. These factors impact the performance of different industries within the sector, leading to fluctuations in the index.

Livestock Production

The livestock production industry encompasses the raising and breeding of livestock for meat, milk, and other products. Factors influencing this industry include:

- Feed costs

- Animal health and disease outbreaks

- Technological advancements in breeding and animal husbandry

Livestock Processing, Live Stock Market Index Performance

The livestock processing industry involves the slaughtering, processing, and packaging of livestock products. Key factors affecting this industry include:

- Consumer demand for meat and other livestock products

- Government regulations and food safety standards

- Competition from alternative protein sources

Livestock Distribution

The livestock distribution industry encompasses the transportation and distribution of livestock products to consumers. Factors impacting this industry include:

- Logistics and transportation costs

- Infrastructure development

- Government regulations and trade policies

Other Related Industries

In addition to the core livestock industries, the Live Stock Market Index also includes related industries such as:

- Animal feed production

- Veterinary services

- Equipment and technology suppliers

The performance of these related industries influences the overall health of the livestock sector and the Live Stock Market Index.

Technical Analysis and Forecasting

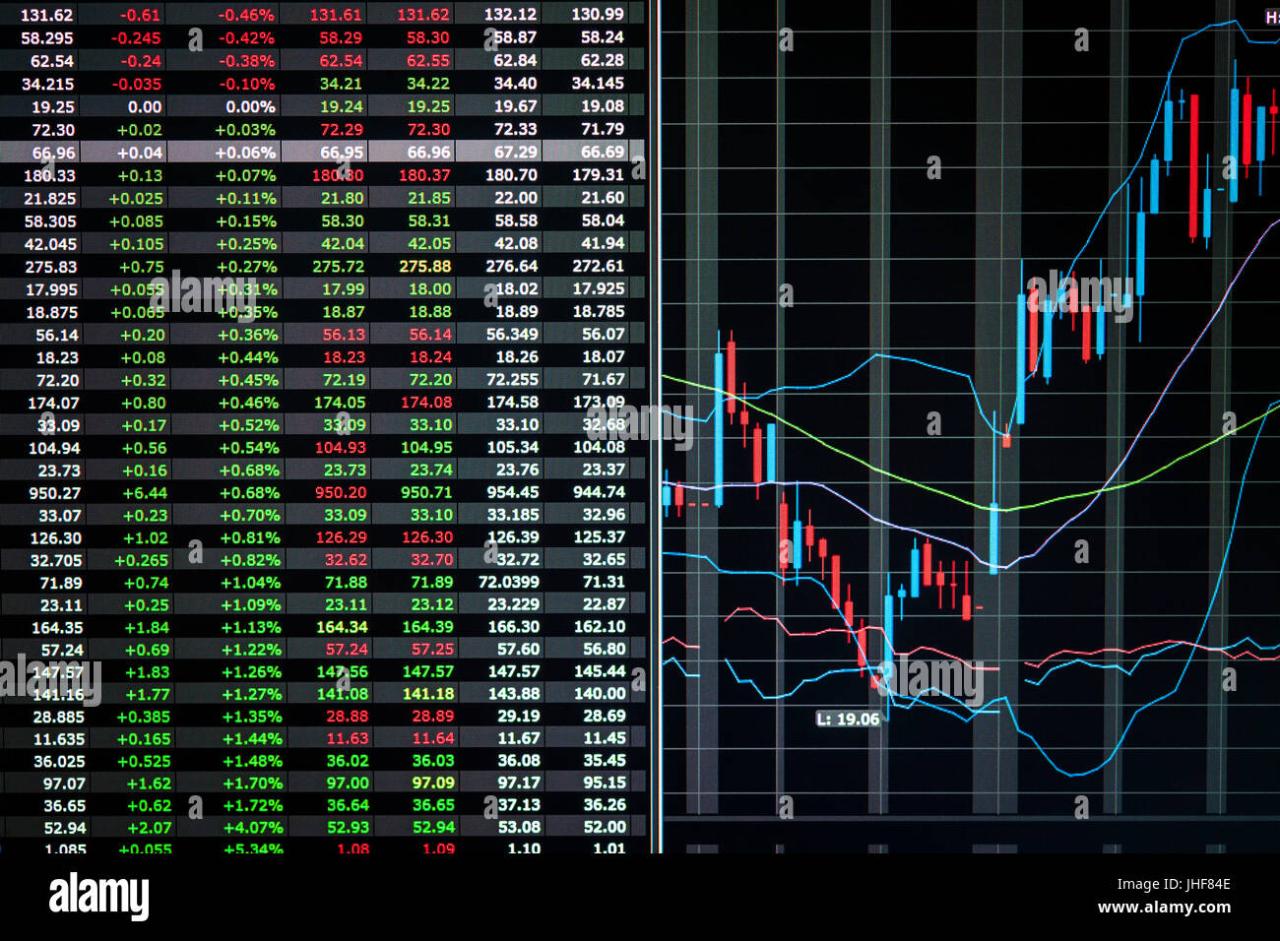

Technical analysis is a method of evaluating securities by analyzing the historical price data of a stock, bond, commodity, or currency. It is based on the assumption that past price movements can be used to predict future price movements.Technical analysts use a variety of indicators to identify trading opportunities.

These indicators include moving averages, support and resistance levels, and momentum oscillators. Moving averages are used to smooth out price data and identify trends. Support and resistance levels are used to identify areas where the price of a security is likely to bounce off.

Momentum oscillators are used to measure the strength of a trend.Technical analysis can be a useful tool for identifying trading opportunities. However, it is important to remember that technical analysis is not a perfect science. There are no guarantees that the future price movements of a security will follow the same patterns as the past price movements.

Moving Averages

Moving averages are a type of technical indicator that is used to smooth out price data and identify trends. Moving averages are calculated by taking the average of the closing prices of a security over a specified period of time.

The most common moving averages are the 50-day moving average, the 100-day moving average, and the 200-day moving average.Moving averages can be used to identify both uptrends and downtrends. An uptrend is indicated when the moving average is sloping up.

A downtrend is indicated when the moving average is sloping down.Moving averages can also be used to identify trading opportunities. When the price of a security crosses above its moving average, it is a signal that the trend is changing.

When the price of a security crosses below its moving average, it is a signal that the trend is changing.

Support and Resistance Levels

Support and resistance levels are areas where the price of a security is likely to bounce off. Support levels are areas where the price of a security has fallen to in the past but has not been able to break through.

Resistance levels are areas where the price of a security has risen to in the past but has not been able to break through.Support and resistance levels can be used to identify trading opportunities. When the price of a security falls to a support level, it is a signal that the price is likely to bounce off.

When the price of a security rises to a resistance level, it is a signal that the price is likely to fall.

Momentum Oscillators

Momentum oscillators are a type of technical indicator that is used to measure the strength of a trend. Momentum oscillators are calculated by comparing the closing price of a security to its previous closing price. The most common momentum oscillators are the relative strength index (RSI) and the stochastic oscillator.Momentum oscillators can be used to identify both strong and weak trends.

A strong trend is indicated when the momentum oscillator is above 50. A weak trend is indicated when the momentum oscillator is below 50.Momentum oscillators can also be used to identify trading opportunities. When the momentum oscillator crosses above 50, it is a signal that the trend is strengthening.

When the momentum oscillator crosses below 50, it is a signal that the trend is weakening.

Investment Strategies and Recommendations: Live Stock Market Index Performance

To capitalize on the performance of the Live Stock Market Index, investors can employ various strategies. The choice of strategy depends on their risk tolerance and investment objectives.

Investment vehicles available include stocks, ETFs, and mutual funds. Stocks provide direct exposure to individual companies, while ETFs and mutual funds offer diversification and professional management.

Long-Term Investment

- Suitable for investors with a long-term horizon and higher risk tolerance.

- Involves investing in stocks or ETFs that track the index.

- Aims to benefit from the long-term growth potential of the livestock sector.

Short-Term Trading

- Appropriate for experienced traders with a high risk tolerance.

- Involves buying and selling stocks or ETFs based on short-term price fluctuations.

- Requires active monitoring and quick decision-making.

Diversification

- Recommended for investors seeking to reduce risk.

- Involves investing in a mix of assets, including stocks, bonds, and real estate.

- Helps to balance the overall portfolio and mitigate losses.

Value Investing

- Suitable for investors seeking undervalued stocks.

- Involves identifying companies with strong fundamentals trading at a discount to their intrinsic value.

- Requires thorough research and analysis.