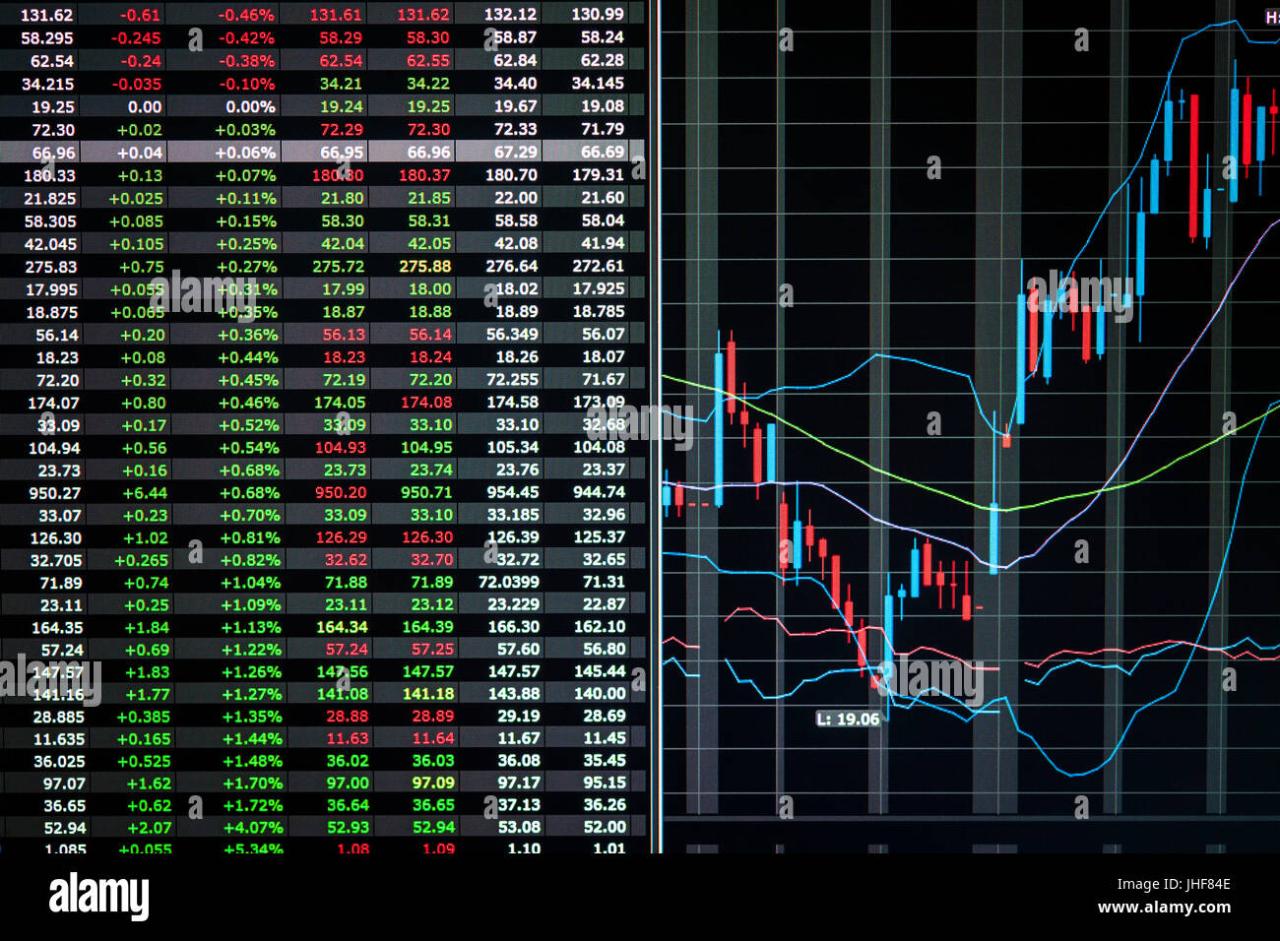

Overview of a Stock Market Live Trading Screen

A stock market live trading screen is a software application that provides traders with real-time data and tools to execute trades. It allows traders to monitor market activity, analyze price movements, and place orders directly from their computers.

Key Components and Layout, Stock Market Live Trading Screen

A typical trading screen consists of several key components:

Charting window

Displays real-time price charts of stocks, indices, or other financial instruments.

Order entry panel

Allows traders to enter and modify orders, specifying the type of order, quantity, and price.

Market depth window

Shows the number of shares available at different price levels.

News and alerts

Provides real-time news and alerts related to the markets and specific stocks.

Watchlist

A customizable list of stocks that traders want to monitor.

Types of Trading Screens

There are various types of trading screens available, each designed for specific trading strategies and preferences. Some common types include:

Single-stock screens

Focus on trading a single stock and provide detailed information about that stock.

Multi-asset screens

Allow traders to monitor and trade multiple stocks, indices, or other financial instruments simultaneously.

Charting-centric screens

Emphasize technical analysis and provide advanced charting tools for analyzing price patterns.

Algorithmic trading screens

Integrate with automated trading systems that execute trades based on pre-defined rules.

Real-Time Data and Market Information: Stock Market Live Trading Screen

A live trading screen provides traders with a wealth of real-time data and market information that is crucial for making informed trading decisions. This data includes:

- Stock prices:The current price of a stock, along with its change from the previous day’s close.

- Volume:The number of shares that have been traded in a given stock.

- Bid and ask prices:The highest price that a buyer is willing to pay for a stock and the lowest price that a seller is willing to accept.

- Market depth:The number of shares that are available to buy or sell at different prices.

- News and headlines:Breaking news and headlines that can affect the price of a stock.

Traders use this data to make informed decisions about when to buy and sell stocks. For example, a trader may buy a stock if the price is rising and the volume is increasing, indicating that there is strong demand for the stock.

Conversely, a trader may sell a stock if the price is falling and the volume is decreasing, indicating that there is weak demand for the stock.

Market Trends and Trading Opportunities

Traders also use real-time data to identify market trends and trading opportunities. For example, a trader may notice that a stock has been trending upwards for several days. This could indicate that the stock is in a bull market and that there is a good opportunity to buy the stock.

Conversely, a trader may notice that a stock has been trending downwards for several days. This could indicate that the stock is in a bear market and that there is a good opportunity to sell the stock.

Order Execution and Management

Order execution and management are critical aspects of trading on a live trading screen. The process involves placing and managing orders to buy or sell securities, and traders use a variety of order types and tools to optimize their execution strategies.

Order Types

There are several types of orders that traders can use, each with its own characteristics and advantages:

- Market Order:Executes immediately at the best available market price.

- Limit Order:Executes only when the security reaches a specified price, providing control over execution price.

- Stop Order:Triggers an order to buy or sell when the security reaches a specified price, used to protect profits or limit losses.

- Stop-Limit Order:Combines a stop order with a limit order, providing additional control over execution price.

- One-Cancels-the-Other (OCO) Order:Places two orders simultaneously, where executing one cancels the other, used to manage risk or implement complex trading strategies.

Order Management Tools

Trading screens offer a range of tools to assist traders in managing their orders:

- Order Book:Displays a list of all open orders for a security, providing transparency and enabling traders to monitor market depth.

- Trade Blotter:Records all executed trades, allowing traders to track their trading activity and performance.

- Position Monitoring:Provides real-time information on a trader’s positions, including profit and loss (P&L) calculations.

- Order Modification and Cancellation:Allows traders to modify or cancel orders before execution, ensuring flexibility and risk management.